Alright, so you’re staring at your bank account and wondering: should I dive into crypto or stick with the good old stock market this year?

This question is popping up everywhere, and honestly, there’s no easy answer.

It all depends on your goals, how much risk you can stomach, and how much time you want to spend watching prices go up and down like a rollercoaster.

Both crypto and stocks have their perks — and their headaches. So, let’s cut the fluff and get to the good stuff. No boring finance jargon, just real talk to help you make a smart call.

What’s Crypto, really?

Crypto isn’t just digital cash your techie friend won’t stop talking about. It’s a whole new financial playground built on blockchain — basically a super-secure digital ledger that makes sure nobody cheats.

In 2025, the big names are still Bitcoin and Ethereum.

Bitcoin’s hanging around $100,000 to $117,685, thanks to something called “halving” (which just means fewer new bitcoins get made, so they’re rarer). Ethereum is around $2,500 to $3,000, powering smart contracts and staking deals — fancy ways people are trying to make crypto work for them.

Plus, there are all these new “trending tokens” tied to AI, Layer 2 tech, and real-world assets. Sounds fancy, but it just means there’s lots of innovation happening.

Why crypto gets love:

- It never sleeps — you can trade anytime, even when you can’t sleep at 3 AM.

- Huge potential to make a ton of money (and lose some too).

- It’s all about cool tech: Web3, DeFi, NFTs — the future, basically.

But, hold up: - It’s crazy volatile. You can make bank or lose it all, sometimes overnight.

- The rules keep changing — regulators are still figuring out what to do.

- Scams and hacks happen. Remember FTX? Yeah, scary stuff.

Stocks: The Old Reliable

Stocks are the OG investment. When you buy a stock, you own a tiny piece of a company — like Apple, Tesla, or your favorite soda brand.

They’ve been around forever and are backed by laws and solid histories.

In 2025, some hot sectors include AI and chips (think NVIDIA, Microsoft), green energy (Tesla’s killing it), healthcare (Pfizer, CRISPR), and everyday staples like Coca-Cola.

Why stocks are still popular:

- The markets are regulated and transparent, so it’s usually pretty safe.

- You can earn dividends — basically free cash just for holding the stock.

- Stocks tend to grow steadily over time.

Downsides? - They’re slower and less exciting than crypto.

- Global events and economics can shake things up.

- Boring, but sometimes boring is good.

Crypto vs. Stocks in 2025 — A Quick Snapshot

| Metric | Crypto | Stocks |

| 5-Year Growth | 20–50% (BTC/ETH) | 6–10% (S&P 500 average) |

| Volatility | 🚨 Very high | ⚖️ Moderate |

| Dividends | ❌ None (except staking) | ✅ Yes |

| Liquidity | ✅ High | ✅ High |

| Market Hours | 24/7 | Weekdays only |

| Regulation | ❓ Uncertain | ✅ Stable |

The bottom line: Crypto can give you big wins but comes with big risks. Stocks are slower but steadier, and they pay you just for holding.

Which One’s Right for You?

Why crypto might be your thing:

- You’re after big growth and don’t mind the ups and downs.

- You’re curious about the latest Web3 and DeFi stuff.

- You’re cool with keeping crypto as a smaller part of your portfolio.

Watch out:

- Prices can swing wildly — your stomach needs to be ready.

- Rules and regulations are still a bit fuzzy.

- Custody is tricky — remember when FTX went belly-up? Yeah, keep your keys safe.

Why stocks might suit you better:

- You want steady growth and maybe some dividends.

- You’re investing for the long haul, like retirement.

- You want regulated, proven assets you can trust.

But:

- Returns are slower.

- Stocks get hit by global politics and interest rate changes.

- Not as exciting, but that’s kind of the point.

The Big Picture: What’s Driving the Markets in 2025?

| Event | Crypto Impact | Stock Impact |

| Fed Rate Cuts | 🚀 Bullish (crypto jumps) | 📈 Growth stocks get a boost |

| U.S. Election | 🤔 Regulatory uncertainty | 🎯 Sector shake-ups |

| Recession Fears | 🛑 Usually bad news | 🟡 Mixed — defensive stocks may hold up |

| Global Rules | Still figuring it out | More predictable |

How to Balance Crypto and Stocks?

Here’s a quick starting point based on your risk tolerance:

- Conservative: 90% stocks, 10% crypto (mostly Bitcoin and Ethereum ETFs)

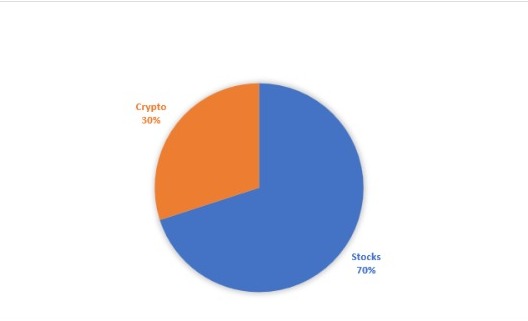

- Moderate: 70% stocks, 30% crypto (add some select altcoins)

- Aggressive: 50/50 split — big crypto bets with Layer 1s, DeFi, and emerging tokens

💡 Pro tip: Use dollar-cost averaging — that means buying a little regularly, so you don’t freak out about timing. And rebalance every few months to keep your portfolio on track.

Does Crypto Actually Help Diversify Your Portfolio?

Yes, but don’t expect it to be a magic shield. From 2022 to 2025, Bitcoin and Ethereum have had a low-to-moderate correlation with stocks — around 0.36 to 0.38. That means they don’t always move the same way.

But during crashes, correlations go up — so crypto might not protect you then. Still, it adds some variety on normal days.

The Lines Are Blurring

In 2025, crypto and traditional finance are merging more than ever:

- Bitcoin and Ethereum ETFs are pulling in big institutional money.

- Liquid staking and derivatives are getting more mature.

- Wall Street funds are dipping their toes into tokenized assets.

What that means:

- Easier access for regular investors like you.

- More mainstream adoption — yay!

- But also, more systemic risk, since everything’s more connected.

So, What’s the Final Verdict?

| Question | Crypto | Stocks |

| High upside? | ✅ Yes | ❌ Limited |

| Passive income? | ❌ Nope (staking only) | ✅ Dividends |

| Can handle volatility? | ⚠️ Very high | ✅ Low to moderate |

| Long-term growth? | ⚠️ Developing | ✅ Proven |

| Regulation-safe? | ❌ Not quite yet | ✅ Yes |

If you want steady growth and peace of mind, stocks are your friend. If you want big, fast gains and don’t mind the risk, crypto might be your jam. Or mix both smartly and sleep better at night.

Real Talk: Alex’s 2025 Portfolio

“I’m 34, got a steady job, and play the long game.

I keep about 70% in stocks — mostly tech and healthcare — and 30% in crypto (BTC, ETH, and a couple of AI coins).

I buy in regularly, review my portfolio every few months, and avoid trying to time the market. Just sticking to my plan.”

— Alex, casual investor

Quick FAQs

Q: Is it too late to get into crypto?

A: Nope! Bitcoin and Ethereum still have long-term potential, especially with ETFs making it easier to get involved.

Q: Which is safer: Bitcoin or Ethereum?

A: Bitcoin is more established and considered safer. Ethereum has more real-world uses but is a bit more complex.

Q: Are crypto ETFs a good way in?

A: Definitely. If you don’t want to mess with wallets and keys, ETFs are a simple, safer way to get exposure.

Your Turn!

So, what’s your plan for 2025?

Going all-in on crypto? Playing it safe with dividend stocks? Or mixing it up?

Drop your thoughts in the comments — I’m all ears!

Subscribe for Weekly Investing Insights

Get the latest trends in crypto, stocks, and personal finance straight to your inbox. No spam — just good stuff.